Written by: Benjamin Bimson CIMA®, CMT® / CIO, Trek Financial

Written by: Benjamin Bimson CIMA®, CMT® / CIO, Trek Financial

As we head into the end of 2022, most investors can probably agree that it has been a very difficult year in the market. And as we look forward to 2023, there are still several things that could be concerning, including raising rates, concerning macro-economic data, persistently high inflation, and continuing volatility in the markets.

Despite the ongoing struggle to decern whether a bottom is or not, there are a few things that likely need to be worked out before recession risk can abate. This question is important because markets have had longer bear markets with more pronounced drawdowns in a recession than in non-recession bear markets. In fact, although painful, the 2022 decline was not the largest or even longest.

Here is an updated plot from Ned Davis Research showing losses and duration of the current and previous bear markets. Chart Source: Ned Davis Research

The data drives us to question if and when a recession could be declared. Certainly, there has been no shortage of opinions on the matter in the media. But some things are more reliable that the headlines, and those are the things that matter right now.

Rates

Rate hikes have an impact on economic expectations. According to the latest readings from The Conference Board, rates are still expected to rise despite the relentless rate hikes we have witnessed in 2022.

Inflation

In addition to the Fed speeches and decisions, inflation and unemployment reports are some of the most watched economic data at the moment. And for good reason. The Federal reserve has reiterated that policy needs to continue to rise to bring inflation back down towards its target of 2%, and with demand substantially exceeding the supply of available workers, labor markets remain out of balance.1

Unemployment

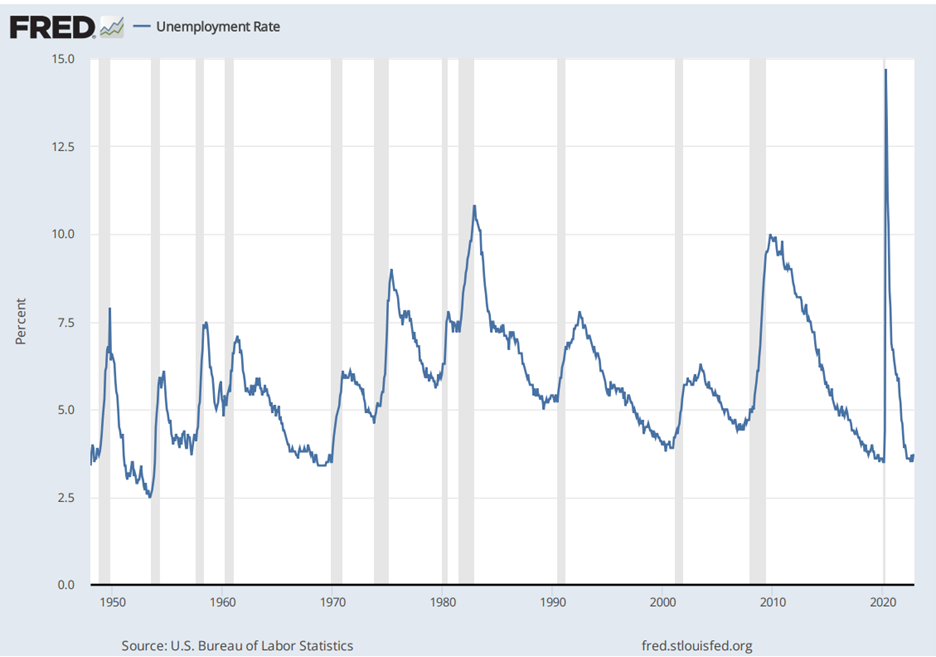

According to the data, we have not had a recession declared by the National Bureau of Economic Research (NBER) without a meaningful rise in unemployment. With that said, last Friday the Labor Department reported non-farm payrolls increased 263,000 for the month of November, while unemployment was 3.7%. The payroll numbers were significantly higher than the estimated 200,000 markets expected.

Be Realistic, Be Prepared

As much as we would love to be in a situation where we could believe that difficult returns and market challenges are behind us, it appears that continued vigilance is necessary. If we have rising rates, diminishing economic conditions, and market volatility, recession risk could grow.

Without inflation coming down to the point where the Fed is comfortable, and unemployment remains low, risk of continual slowdown and market volatility remains high. The Fed could raise interest rates in response to stubborn inflation and job growth. However, the risk of the Fed raising rates too far and pushing the economy into recession increases. Unfortunately, markets will likely continue to react until more clarity is available and we will continue to be data driven in our assessments and portfolio decision-making.

2022 was hard for many people. 2023 may be difficult too, but it also will likely be full of opportunities to learn and do better. Remaining optimistic that we can always do better is one way to combat the feelings that can rise in each of us and attempt to derail us from our more meaningful goals.

We cherish our good relationships and look forward to a new year! Happy holidays!

Sources

1. https://www.federalreserve.gov/mediacenter/files/FOMCpresconf20221102.pdf

2. https://www.cnbc.com/2022/12/02/jobs-report-november-2022.html

Investment Advisory Services offered through Trek Financial LLC., an (SEC) Registered Investment Advisor.

Information presented is for educational purposes only. It should not be considered specific investment advice, does not take into consideration your specific situation, and does not intend to make an offer or solicitation for the sale or purchase of any securities or investment strategies. Investments involve risk and are not guaranteed, and past performance is no guarantee of future results. For specific tax advice on any strategy, consult with a qualified tax professional before implementing any strategy discussed herein. Trek 476