Written by: Trek Investment Committee

As 2024 progresses, the U.S. stock market continues to navigate through a complex economic landscape. Strengthened by robust corporate performances and evolving economic indicators, the market offers a compelling narrative of resilience amidst global economic shifts. This setting invites a deeper exploration into the sectors and trends shaping the current financial environment.1

Market Trends and Challenges

- The first half of 2024 has showcased strong market performance, with momentum that has potential to continue. Insights from U.S. Bank supports an optimistic outlook for the S&P, reinforced by solid earnings forecasts that are expected to maintain a favorable environment for equities.2

- Recent Personal Consumption Expenditures (PCE) reports show that core inflation slowed to 0.1 percent in May over the prior month and 2.6 year-over-year – the lowest annual rate in three years. However, Federal Reserve officials have worked to communicate that despite the progress made on inflation in recent months, it remains above the Fed’s 2% target. 3

- The technology and communications sectors, previously losing momentum, have regained strength. Companies like Nvidia, Microsoft, Amazon, and Google, which are less affected by interest rate changes due to their significant cash reserves and low borrowing needs, continue to drive the markets to new highs.2

- New home sales fell 11.3% in May – the largest month-over-month drop in a year and a half – while the supply of new homes hit a 16-year high.4

- Q1 GDP revised slightly to 1.4% higher, and durable goods increased in May.5,6

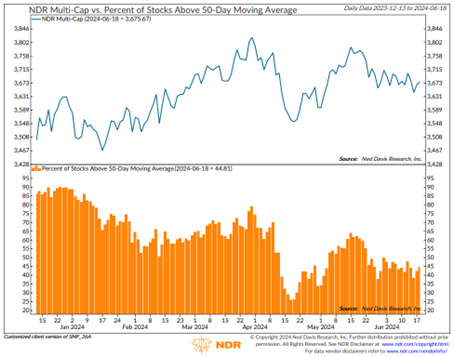

This chart shows the number of stocks above their 50-Day moving average, which have been declining over the past month even as stock markets have made new highs. Source: Ned Davis Research

Outlook

As the year unfolds, a cautiously optimistic picture emerges for U.S. stocks. The synergy of solid earnings forecasts, stabilizing indicators, and strategic sector performance could hold a supportive backdrop for equities. However, the optimism is balanced by the risks associated with high market valuations, particularly in tech-driven sectors that have propelled market highs. This dynamic environment calls for vigilant monitoring and adaptability to navigate the economic landscape ahead.

Sources:

1- https://www.jpmorgan.com/insights/outlook/market-outlook/tmt-100-trading-days-in-why-2024-is-different

2-https://www.usbank.com/investing/financial-perspectives/market-news/is-a-market-correction-coming.html

3-https://www.bea.gov/news/2024/personal-income-and-outlays-may-2024

4- https://www.reuters.com/markets/us/us-new-home-sales-slump-six-month-low-may-2024-06-26/

5- https://www.bea.gov/data/gdp/gross-domestic-product#:~:text=Gross%20Domestic%20Product%20(Third%20Estimate,by%20Industry%2C%20First%20Quarter%202024&text=Real%20gross%20domestic%20product%20(GDP,to%20the%20%22third%22%20estimate.

6- https://www.census.gov/manufacturing/m3/adv/pdf/durgd.pdf

Disclosures:

This overview presents a cautious interpretation of current economic indicators and their potential implications for investors. It’s important for investors to remember that market conditions are inherently uncertain and subject to change. The information provided here should not be considered as personalized investment advice or a prediction of future market movements. Investors are encouraged to consult with their financial advisor to discuss their individual financial situation and goals. A comprehensive investment strategy should consider the investor’s risk tolerance, investment time horizon, and any changes in economic conditions.

Investment Advisory Services offered through Trek Financial LLC, an investment adviser registered with the Securities Exchange Commission. Information presented is for educational purposes only. It should not be considered specific investment advice, does not take into consideration your specific situation, and does not intend to make an offer or solicitation for the sale or purchase of any securities or investment strategies. Investments involve risk and are not guaranteed, and past performance is no guarantee of future results. For specific tax advice on any strategy, consult with a qualified tax professional before implementing any strategy discussed herein. Trek 24-286