Written by: Benjamin Bimson CIMA®, CMT® / CIO, Trek Financial

Written by: Benjamin Bimson CIMA®, CMT® / CIO, Trek Financial

2022 may seem like a long time ago, considering it was nearly six months ago. It was a challenging year for investment portfolios focused on just stocks and bond asset allocations, as most risk assets performed poorly in terms of investment returns. However, looking at the returns so far this year, many people are relieved to see improvements. This raises a common question about how inflation, interest rates, and long-term trends impact investors’ decisions regarding future returns and strategies to achieve their financial goals.

The traditional 60/40 portfolio, consisting of 60% equities and 40% bonds, has long been considered a reliable diversification strategy.1 While the specific composition of the equity and bond portions has changed over time, the general idea is that holding this mix can provide more consistent returns and lower risk. The question of whether the 60/40 portfolio is still effective has sparked many discussions on the internet.

The notion of the 60/40 portfolio being “dead” is often fueled by provocative titles that generate clicks in today’s society. Instead of focusing on whether the 60/40 portfolio is dead or alive, it would be more valuable to examine the environments in which it performs well and where it may face challenges. Fortunately, there is an abundance of data available to address this question.

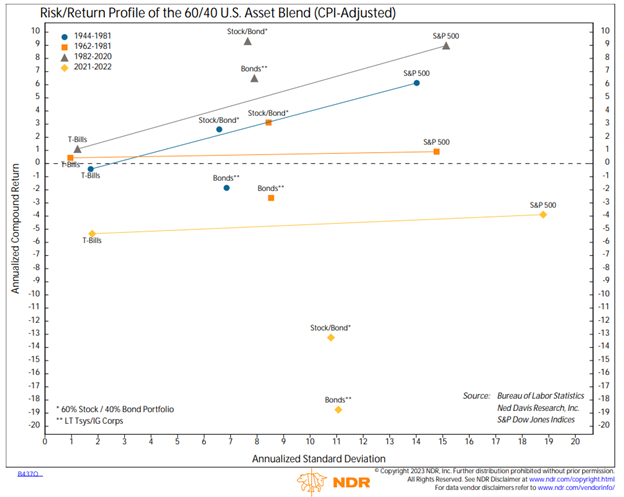

Throughout history, there have been periods of rising inflation, such as 1944-1981, and periods of falling inflation, like 1982-2020. Some inflation increases have been more intense, as seen in 2021-2022. Prior to that, the last period of extreme inflation was between 1961-1981.2

The 60/40 portfolio exhibits different real return characteristics in each of these scenarios. According to Ned Davis Research, the inflation-adjusted returns for a 60/40 portfolio during longer-term rising inflation have been around 3% per year. In more extreme cases like 1961-1981 and 2021-2022, returns were negative. On the other hand, when inflation has been falling over the long term, such as in 1982-2020, annual returns were 9% (As illustrated in the chart).

Chart Source: Ned Davis Research Group

This information is important for investors as they plan. Simply looking at the past 10-20 years will not suffice to construct a portfolio if inflation remains higher than the Federal Reserve’s 2% target, which is a real possibility.

However, investors have options. In the event of rising inflation, active management and alternative strategies can be a solution rather than simple passive investing. If inflation remains range-bound or declines, it could be an excellent opportunity for 60/40 portfolios. Despite claims that the 60/40 portfolio was dead in 2022, it has potential to perform much better this year, especially since interest rates are higher but inflation is coming down and likely to stabilize. In fact, it could offer similar benefits to more complex portfolios that include alternative investments like real estate, private credit, commodities, and precious metals, as seen in 2022. While the more complicated models may still provide some value, it may not be as significant as it was at the beginning of 2021.

Of course, it is essential to carefully consider your specific financial goals and work with your advisor to determine the best approach for your situation. By doing so, you can gain a better understanding of the risks and rewards associated with different strategies and solutions. It is comforting to know that despite some people’s belief that the 60/40 portfolio was no longer effective, it is potentially still a viable option.

Sources

- What is the 60/40 Portfolio (And Should You Have One?).com/ November 3, 2022 [6/9/23]

- Annual Inflation…virtually unchanged. InflationData.com. May 10, 2023 [6/6/23]

Investment Advisory Services offered through Trek Financial LLC., an (SEC) Registered Investment Advisor.

Information presented is for educational purposes only. It should not be considered specific investment advice, does not take into consideration your specific situation, and does not intend to make an offer or solicitation for the sale or purchase of any securities or investment strategies. Investments involve risk and are not guaranteed, and past performance is no guarantee of future results. For specific tax advice on any strategy, consult with a qualified tax professional before implementing any strategy discussed herein. Trek 23-591