Have you noticed Mom or Dad showing signs of decline?

Are you worried about your elderly uncle living at home by himself?

You’re not alone.

Many of us will find ourselves making care decisions for our parents or other beloved elders.

It’s not an easy place to be because it’s hard to see them struggle to live independently.

Here are 7 tips to help make helping your loved ones go more smoothly.

Tip #1: Start talking about care plans as early as possible

Many elders shy away from conversations about their future care needs. However, gently bringing attention to the topic from a place of love and support long before urgent needs arise can help the whole family get on board with a plan.

With many desirable communities experiencing high demand, finding a placement may take longer than expected, so planning ahead helps.

Tip #2: Identify any current needs

If you already know that your parent or elder needs help, it’s useful to identify which “activities of daily living” they may no longer be able to manage. Knowing this will help you gauge what kind of assistance they need.

An elder with physical issues may struggle with bathing or dressing but still be able to handle their finances.

An elder experiencing cognitive decline may be able to handle their personal care but need help with transportation, money management, and housekeeping.

Finding the right level of care for their needs can help them remain independent as long as possible and keep costs in check.

Tip #3: Identify their financial resources

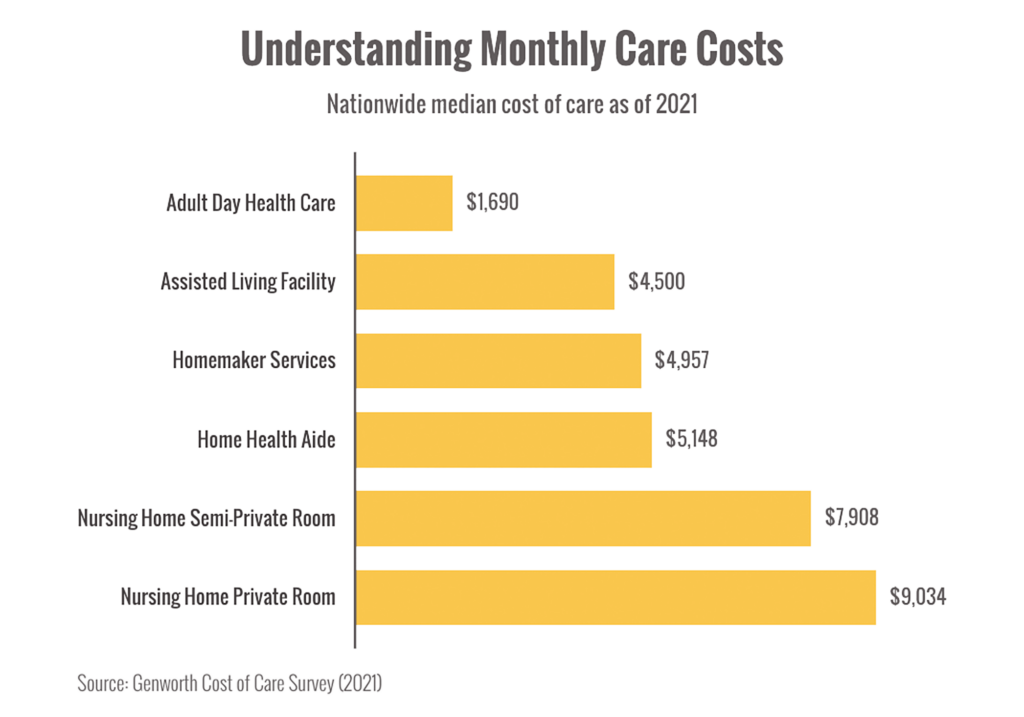

Care can cost quite a bit, so knowing what assets your parents have—income, investments, long-term care policies, insurance, benefits, etc.—can help determine what they can afford.

The chart below shows some nationwide care statistics, but the actual cost of a placement will be influenced by location, level of care, type of facility, pricing structures, and more.1

Tip #4: Be clear about your own resources and expectations

Many, many factors influence care expectations within families. Being clear with your family about what you can and cannot contribute in terms of time, money, and caregiving is critical.

It may be a difficult conversation, especially if your family’s expectations of you are outside what you can provide. However, setting boundaries and accountability creates clarity about what services mom and dad will need.

Tip #5: Research their options

There are a lot of ways to help your loved ones age gracefully. Learning about which services and facilities are available and within their resources can empower you to help them make good decisions.

Sometimes, home renovations and local support can be enough to support aging-in-place. In other cases, moving to a care community can offer elders the support they need to thrive.

Tip #6: Understand the steps involved in getting into a community

Many facilities operate with a waitlist so it may be challenging to quickly find a placement when the time comes to move.

Starting early helps. Asking for referrals, taking tours of facilities together (if they’re willing), and becoming informed about how each community works can help you all understand the process.

When you’ve identified a place, you may be able to place a deposit to get on the waitlist, giving them the option to accept a spot when it opens.

Tip #7: Ask for help

You’re not alone in this journey.

If you’re facing a need to find care for your parents, please reach out to your financial professional for guidance.

- https://www.genworth.com/aging-and-you/finances/cost-of-care.html.

Investment Advisory Services offered through Trek Financial LLC., an (SEC) Registered Investment Advisor.

Information presented is for educational purposes only. It should not be considered specific investment advice, does not take into consideration your specific situation, and does not intend to make an offer or solicitation for the sale or purchase of any securities or investment strategies. Investments involve risk and are not guaranteed, and past performance is no guarantee of future results. For specific tax advice on any strategy, consult with a qualified tax professional before implementing any strategy discussed herein. Trek 23-603