Written by: Trek Investment Committee

Happy New Year, and welcome to 2024! As we shift our focus towards the economic and investment landscape for the coming year, let’s take a moment to revisit some of the major topics that are shaping current discussions and possible perspectives.

As we return from celebrating the holidays with family and friends, attention may turn to topics such as the actions of the Federal Reserve, their decisions regarding interest rates, and the resulting economic scenarios (soft, hard, or no landing). Additionally, close attention is being paid to the ongoing efforts to align inflation with the long-term unemployment targets set by the Federal Reserve.

The concept of a soft landing has been a recurring theme in market discussions throughout history. Matt Novak, in an article published by Forbes nearly a year ago, highlighted the numerous instances in history when soft landings were predicted, regardless of how previous economic cycles ultimately concluded. Novak concluded by emphasizing a crucial point: “Whether or not we dip into a recession, it’s important to remember that whatever happens has been engineered. It’s not a force of nature.” 1

When a committee of financial professionals adjusts interest rates, either to slow down economic activity by raising rates or to stimulate it by cutting rates, this is essentially a form of financial engineering. Reflecting on this article illustrates the challenging nature of achieving a soft landing.

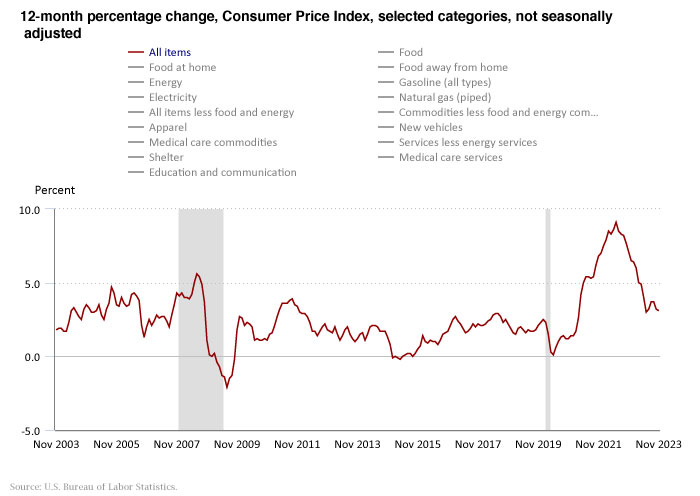

So, what might we expect this time around? Based on the inflation data provided by the US Bureau of Labor Statistics, inflation has significantly decreased from its peak values as seen in the chart below.

Chart: The chart illustrates the evolving probability model over the past three and a half years.

The next report, due on January 11, 2024, will include December 2023 figures—a highly anticipated update for both the Federal Reserve and investors. Many are hopeful that the Fed will start reducing interest rates sometime this year.

The Fed’s second mandate is to maintain unemployment as close to full employment as possible, ensuring that everyone seeking employment can find a job. In 2022, Olivier Blanchard, Alex Domash, and Lawrence Summers, three renowned academics, published a paper that suggested that to bring down high inflation, there would need to be an increase in unemployment. However, despite inflation decreasing significantly, unemployment data hasn’t shown a meaningful rise since the paper was published.2

Chart: The stability in employment is likely one of the key factors preventing the economy from slipping into recession.

This asks the question of whether a soft landing is being achieved. The data supports that theory… for the moment. The bigger question is whether it can remain this way. Certainly, if a soft landing can be achieved and maintained, this would be a favorable environment for both stocks and bonds. However, the growing bigger question is whether it can be maintained, even if achieved.

In practical terms, if we observe inflation decreasing and the Fed cuts interest rates too hastily, there’s a risk of a second bout of inflation, which would negatively affect both stocks and bonds. Conversely, if rates aren’t reduced soon enough, economic pressures could rapidly drive-up unemployment, potentially leading to a recession, which would also be detrimental to stocks.

As we step into 2024, the possibility of multiple options materializing adds a new layer of complexity to interpreting the data. The late 2023 rally seems to hinge on the hope that the Fed will cut rates sooner rather than later. However, if unemployment remains low, those rate cuts may be postponed, introducing the risk of increased inflation. If another economic issue arises and unemployment spikes, the risk of a recession becomes more pronounced.

The Federal Reserve faces a challenging year in 2024, and investors must remain adaptable as various outcomes present a wide range of return possibilities.

Sources

- 5 Predictions For an Economic ‘Soft Landing’ That Were Totally Wrong. Matt Novak, Forbes.com 2/2023

- Bad News for the Fed from the Beveridge Space. Oliver Blanchard, Alex Domash, Lawrence Summers, PIIE.com 7/2022

Investment Advisory Services offered through Trek Financial LLC., an (SEC) Registered Investment Advisor.

Information presented is for educational purposes only. It should not be considered specific investment advice, does not take into consideration your specific situation, and does not intend to make an offer or solicitation for the sale or purchase of any securities or investment strategies. Investments involve risk and are not guaranteed, and past performance is no guarantee of future results. For specific tax advice on any strategy, consult with a qualified tax professional before implementing any strategy discussed herein. Trek 24-108