Written by: Benjamin Bimson CIMA®, CMT® / CIO, Trek Financial

Written by: Benjamin Bimson CIMA®, CMT® / CIO, Trek Financial

We are still dealing with the COVID-19 pandemic, social unrest, and a major election year. While markets enjoyed a nice recovery in April and May, June has been a series of starts and stops in the market.

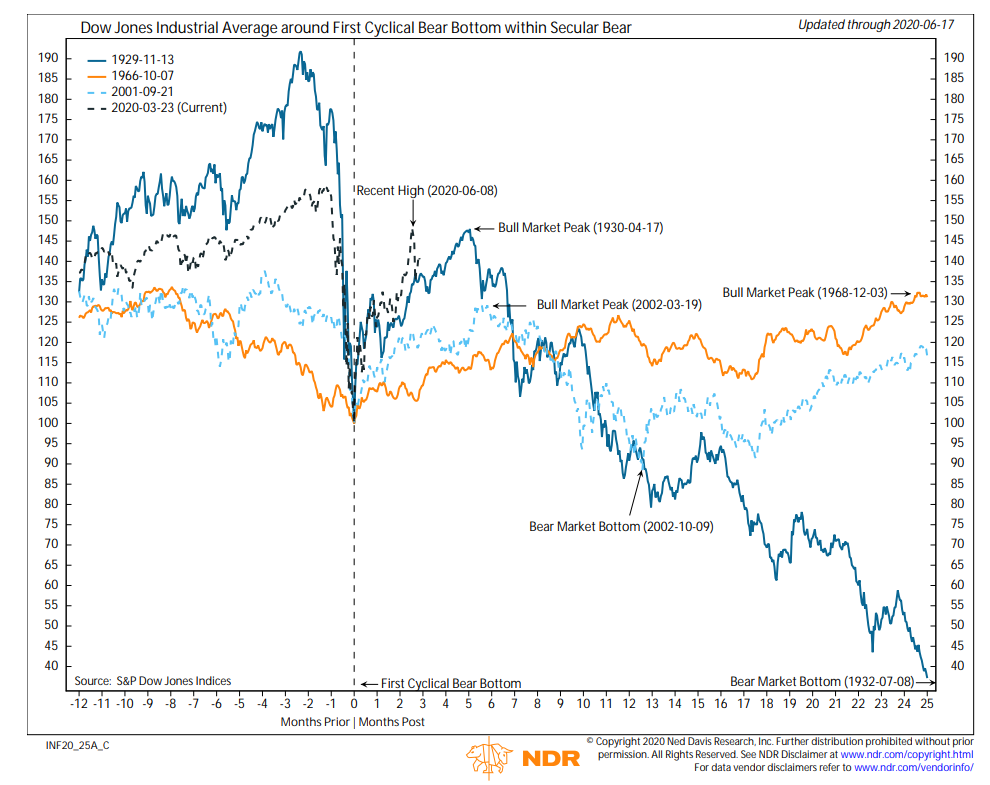

At this stage it is too early to know whether or not we are going to continue our secular bull market once we are on secure economic footings, or if we are going to bein a cyclical bear market even after we are out of recession.

CLICK IMAGE TO VIEW: Here is what the Dow Jones Average looks like around the first cyclical bottom within a secular bear market.

We are living in a time, and under conditions that have heightened risks. Across all asset classes, risks are elevated today. Bond yields on treasuries are at extreme lows, stocks are overvalued based on price to earnings ratios (P/E ratios) and corporate debt is at a high.

What does this mean for our second half? The honest answer is that it all depends on whether corporations can continue to operate without further economic shocks due to full shutdowns. Monetary policy is very accommodative, and rates are not expected to rise for the foreseeable future. Additionally, fiscal policy has been favorable with the PPP program and other lending to businesses that have been affected by the current pandemic.

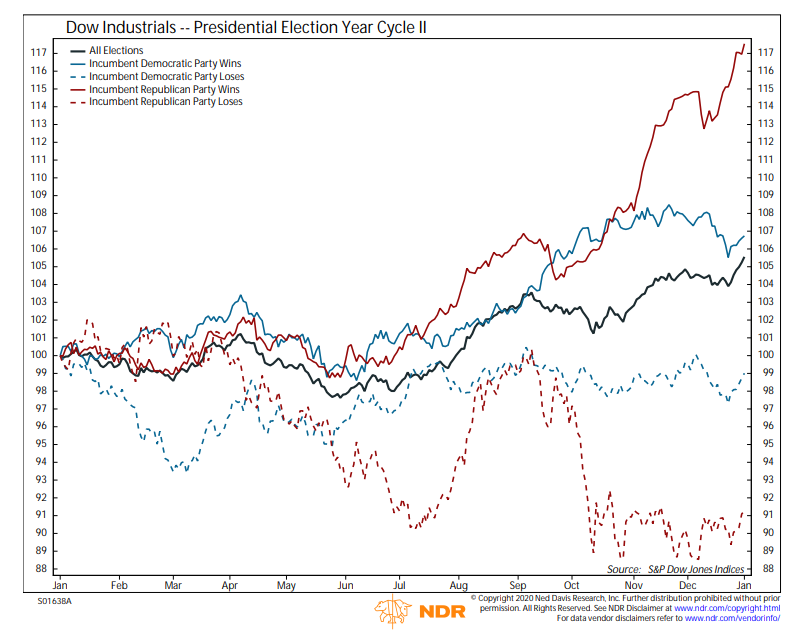

As we enter the last remaining quarter prior to a major presidential and congressional election cycle, the market may begin trying to anticipate the election. The most extreme reactions tend to be when an incumbent Republican President wins or loses.

Therefore, as we move into the second half of an already difficult year, 2020 remains highly uncertain in terms of where we go from here.

Investors should make sure that they are comfortable with the strategies they have chosen to use to best be prepared for all potential outcomes.

We can wish that we had a better insight into where we go from here, but it is far more responsible to look at the facts and make decisions in a disciplined manner than rely on hunches and best guesses. Even using polling data can lead to some quite different outcomes and they seem to have been much less accurate in the past presidential election cycle than other cycles.

We hope that you all have a great 4th of July, celebrating the freedoms we enjoy, and thank those who are pressing on to protect, promote and make the United States even better for all Americans.

View More Articles

Investment advisory services are offered through Trek Financial, LLC., an SEC Registered Investment Adviser. Information presented is for educational purposes only. It should not be considered specific investment advice, does not take into consideration your specific situation, and does not intend to make an offer or solicitation for the sale or purchase of any securities or investment strategies. Investments involve risk and are not guaranteed, and past performance is no guarantee of future results. For specific tax advice on any strategy, consult with a qualified tax professional before implementing any strategy discussed herein. Trek FG 20-8f